Understanding Annuities

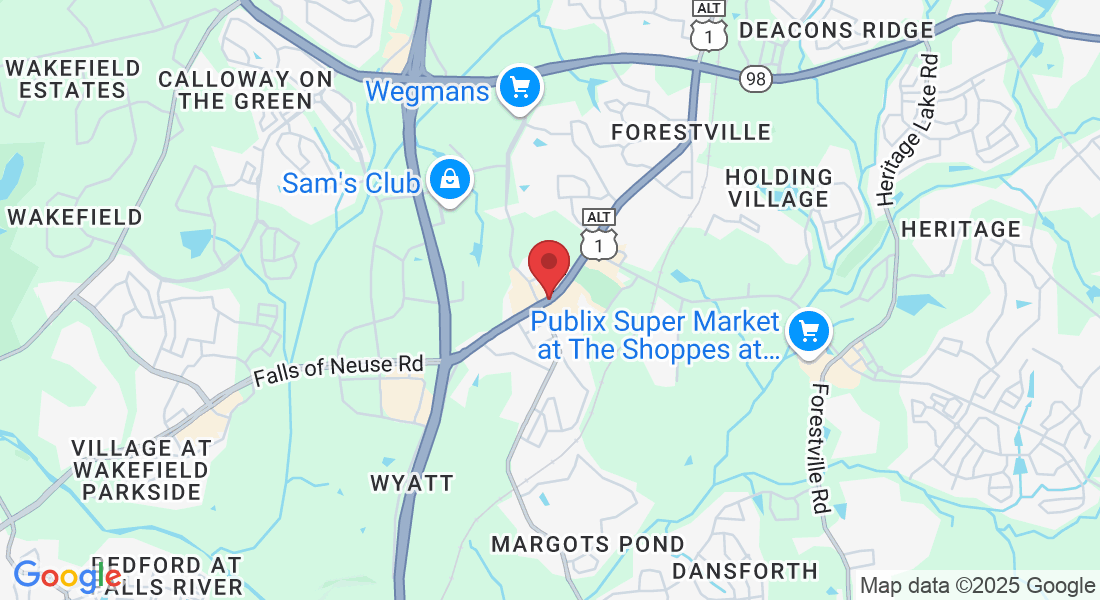

An annuity is a contract between you and an insurance company designed to meet retirement and other long-range goals. Annuities offer a variety of benefits, including the potential for tax-deferred growth and guaranteed income for life. At Neuse Consulting Group in Wake Forest, North Carolina, we're here to help you understand the different types of annuities and how they can fit into your retirement strategy.

Fixed Annuities: These provide a guaranteed fixed interest rate for a specified period.

Variable Annuities: These allow you to invest in various sub-accounts that can grow with the market.

Indexed Annuities: These are tied to a stock market index, offering the potential for higher returns.

Types of Annuities

When considering an annuity, it’s crucial to understand the different types available. Each type of annuity has its own features and benefits, depending on your retirement plan and goals.

Immediate Annuities: Provide income payments that begin almost immediately after you buy an annuity.

Deferred Annuities: Allow your investment to grow tax-deferred until you start receiving income at a future date.

Fixed and Variable Annuities: Offer either a fixed interest rate or investment options in sub-accounts.

Income Annuities: Provide a stream of income for life or a set period.

How Variable Annuities Work

A variable annuity is an annuity that allows you to allocate your premiums among different investment options. These can include stocks, bonds, and mutual funds. Variable annuities provide the potential for growth but also come with risks.

Investment Options: Choose from a variety of sub-accounts.

Income Stream: Provides income payments that can fluctuate based on investment performance.

Death Benefit: Payable to your beneficiaries upon your death.

Surrender Charge: A fee if you withdraw funds early.

Questions About Annuities

Considering an annuity can bring up many questions. Here are some common ones we receive at Neuse Consulting Group:

What is an annuity contract? An annuity is an annuity contract between you and an insurance company.

How do I decide which type of annuity is right for me? This will depend on your retirement goals and risk tolerance.

Can I buy an annuity with pre-tax dollars? Yes, but it would be considered a non-qualified annuity.

What are the tax implications? Annuities offer tax-deferred growth, but you may face taxes upon withdrawal.

How Annuities Fit into Your Retirement Plan

Annuities can provide a stable income stream as part of your broader retirement strategy. Here are some reasons why you might consider investing in annuities:

Guaranteed Retirement Income: Annuities provide a guaranteed income for life.

Tax-Deferred Growth: Your investment grows tax-deferred until you start receiving income payments.

Flexible Options: Depending on the annuity, you can choose between fixed and variable options.

What Annuities Can Provide

Beyond retirement income, annuities offer several other benefits:

Death Benefit: Provides a payment to your beneficiaries upon your death.

Income for Life: Ensures you won't outlive your retirement savings.

Investment Flexibility: Options like registered index-linked annuities can provide growth potential.

Deferred Income: Deferred income annuities let your investment grow before you start receiving payments.

Is a Non-Qualified Annuity Right for You?

A non-qualified annuity is funded with after-tax dollars, meaning you won’t receive an immediate tax break. However, these annuities still offer tax-deferred growth and other benefits:

No Contribution Limits: Unlike qualified plans, there are no limits on how much you can invest.

Flexible Payouts: Choose how and when you receive your income payments.

Estate Planning: Non-qualified annuities can be used in estate planning to provide for your heirs.

Which Annuity is Right For You?

Choosing the right annuity depends on your individual needs and retirement goals. Here are some factors to consider:

Risk Tolerance: Are you comfortable with market fluctuations, or do you prefer a guaranteed fixed interest rate?

Income Needs: Do you need immediate income, or can you defer it to a future date?

Investment Goals: Are you looking for growth potential or a stable income stream?

Contact Neuse Consulting Group Today

Ready to learn more about how annuities can fit into your retirement plan? Call Neuse Consulting Group in Wake Forest, North Carolina at (984) 263-3254 today. Our team of professionals is here to help you make the best decision for your financial future.

See Which Plans Are In Your Area Today

We do not offer every plan available in your area. We represent a number of MA organizations, which offer products in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program to get information on all of your options.